Archives

Contribute

| 3 Ways To Maximize Social Security Benefits |

Jai M Dev

06/05/2019

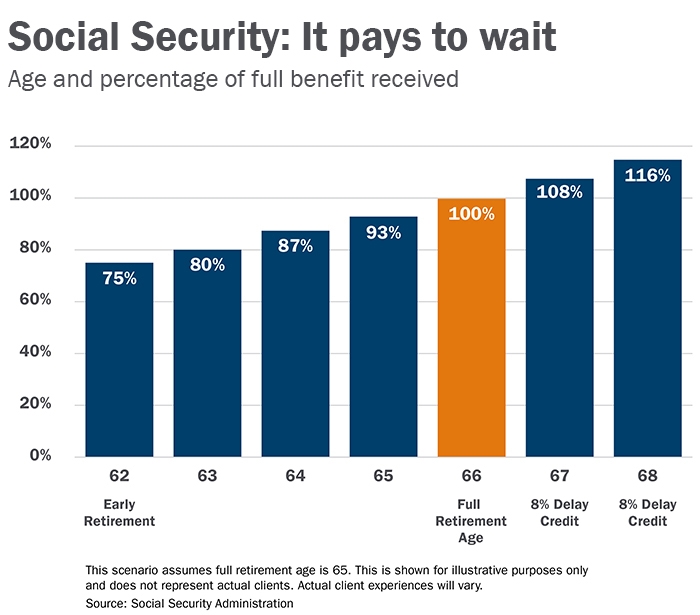

As you work with your advisor, be aware of three ways to get the most from your Social Security benefits: If you postpone taking Social Security benefits until after your full retirement age, you will receive a higher monthly benefit. For example, if your full retirement age is 66 and you wait to collect until age 70, your Social Security income will be 76% higher than it would have been at age 62 (the earliest you can collect). Your advisor can show you how postponing Social Security benefits could favorably impact your financial goals. Keep in mind that delaying Social Security benefits may mean using other assets to fund your retirement. You’re eligible to take either all of your own benefit or half of your spouse's benefit, whichever is higher. This also applies if you’re divorced but were married for at least ten years, or if your spouse died. If you are widowed, you have the option to collect survivor benefits — which you can start as early as age 60 — and then switch to your own benefits later. If you’re unsure which approach to take, talk to your advisor or use the calculators on the Social Security Administration website to find out how to get the largest benefit due to you. Continuing to work after you begin collecting Social Security benefits can also impact your benefits. For example: Your financial advisor can help you calculate your investment earnings so you can plan ahead for tax season. It’s never too early to develop a Social Security strategy. Despite news that Social Security is projected to deplete its trust funds in 2035, much could change before then. Your advisor can help you incorporate your projected benefit into your overall portfolio and plan for income based on your financial goals.Key Points

1. Wait to begin collecting, if you can.

2. Make sure you get all of what’s yours.

3. Plan for the tax impact of extra earnings.

Check in with your advisor today

You may also access this article through our web-site http://www.lokvani.com/