Archives

Contribute

| EU Referendum - Economic Analysis |

Anil Bhanot

06/16/2016

As UK votes on June 23rd, one should be aware that:

- UK’s GDP the Gross Domestic Product, the wealth of the nation, is £1,810 billion

- UK’s Budget, the taxes collected by the Chancellor, is £760 billion (42% of GDP)

- UK pays into EU net £8.5 billion ( less than 1/2 percent of GDP)

- UK pays foreign aid £8.5 billion revenue plus £2.5 billion capital so total £11 billion (0.6/0.7 percent of GDP)

- London GDP is 1/4 of the UK’s GDP, equivalent to Belgium or Sweden’s national GDP and the City with its financial institutions has strengthened its market lead in the European financial markets

- UK financial institutions have a ‘pass-porting right’ to do business freely without opening a branch there

- Euro reached parity with the £ in 2009/10 but recovered by 2012 to date, averaging at 1.30 Euro’s to the £

- The last 2008 recession was started by USA’s and UK’s subprime lending which was primarily unregulated banking activity

- EU regulation primarily is to protect the consumer by harmonising the laws in the EU wide larger market of 500 million, say cars safety, pollution controls, health & safety, employee rights and so on

- Foreign investment into the UK as part of the EU market was £540 billion in the last decade

- UK’s exports in 2014 were to EU £230 billion, USA £88 billion, China £18 billion

The UK could easily let France take its 5th position in the GDP rankings as its not far off the UK position, let us maintain our premier 5th position. USA is first, China 2nd, Japan 3rd, Germany 4th, UK 5th, France 6th, India 7th, Italy 8th, Brazil 9th, and Canada 10th.

Brexit Arguments

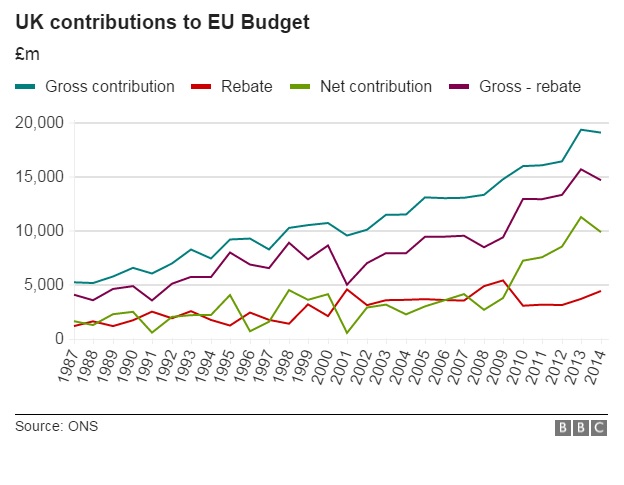

The principal economic argument that the Brexit camp makes about the benefits of leaving the EU is based around the significant amount of money that we have to pay to be a member of the EU. They have said that we pay a total of £350 million a week in our contribution for the EU budget. The way in which this money is spent is beyond our control, as we hand the money over to Brussels and it is people there who decide. Those who argue for Brexit believe that this money could be better spent by the UK government on UK priorities; not only should we be able to decide how we spend this money but we should also be able to spend it on something that benefits. This is an issue that Brexit sees as particularly pressing when considering the fact that numerous cuts to UK services have had to be made since the financial crisis.

Besides the sheer amount we pay, we also pay more than most other member countries. The majority of countries contribute between 00.6% (Malta) and 2.04% (Denmark) of the EU budget. There are, though, just four countries that pay over 10% of the budget; what’s more, these four countries (Germany, France, UK, Italy) make up over 60% of the entire EU budget. The UK is amongst these four countries, we contribute 12.57% of the EU budget. Those for Brexit believe that this is a disproportionate contribution, and that irrespective of what our government attempts we will not be able to negotiate paying a smaller percentage. Moreover, they point to the fact that not only have our contributions always increased historically, but they are also predicted to continue rising. Therefore, the amount which we now pay, which is already problematic, will only ever grow.

Besides the cost of membership the Brexit camp has also argued that being in the EU, although historically beneficial as far as trade is concerned, will hinder us going forward. It is true that the EU has become the UK’s biggest trading partner, but in recent years trade with the EU has actually been falling. The EU is, they argue, becoming a less important player on the world scale. The EU’s global share of GDP has been declining as it continues to struggle from the effects of the financial crisis. Other countries, in particular BRIC countries such as China and India, are seeing their share grown, they

are becoming increasingly important and in accordance with the Brexit camp are who we should be focusing on. Our membership of the EU means that we are unable to negotiate our own trade deals with these countries, deal that could be more beneficial and that will be increasingly important as the world continues to change.

Remain Arguments

As was the case with immigration the Remain camp besides putting forward its own arguments has also been critical of some of the points made by the Brexit camp. The figure of £350 million a week in contributions to the EU does not take into account the rebate that the UK receives from the EU; the figure when the rebate is considered is actually £250 million. Moreover, besides the £4.5 billion that the EU spends in the UK, the fact that almost £1 billion of UK money given to the EU is spent on international aid also has to be taken into account. The UK government has promised to spend 0.7% of GDP on international aid (this amounts to nearly £12 billion), this figure counts towards that; this means that this is money the UK would need to spend outside of the EU if the government is to remain committed to its aid target. Besides this questioning of the amount contributed, the remain side also points out that this figure, which ever of the two may be correct, is actually not as important as those arguing for Brexit have tried to make people believe. As a percentage of the government’s total spending, what goes towards the EU is quite minor.

It has to be said that the majority of the economic arguments that have been put forward have been in favour of the Remain camp. A series of reports have been produced by international organisations, including the OECD and IMF that state that Britain would be economically worse off if we vote leave on June 23rd. Also, the majority of British economists have come to this same conclusion.

These economists have pointed out the fact that the British economy has greatly benefited from being in the EU, as have the economies of other member states. Membership of the Union gives each individual power more clout than they would have alone; better deals can be negotiated and issues relating to economies of scale come into play. Moreover, trade within the Union has been made easier and is financial

benefiting all involved. They are also certain that we will continue benefiting from membership.

Those who argue for Brexit may point to the fact that the amount we trade with the EU is declining whilst the amount we trade with others increases. The fact remains, though, that the EU is by far our biggest trading partner. For example, in 2014 UK exports to the EU were worth £230 billion; the equivalent figure for our exports to the USA was £88 billion and to China £18.7 billion. Both imports and exports to the EU are over twice as much as those to any other market.

It does not seem to make economic sense to do anything that would deteriorate our ability to trade freely, as well as our relationship, with a block that accounts for so much of our trade. Moreover, those in favour of staying in the Union also point out that after a Brexit the international trading market would become more fragmented; the leaders, though, would be the US, China and the EU. The idea that the UK as a standalone player could hold sway in this scenario is seen as naïve.

This is particularly so when we consider the number of other economic benefits that are attached to our membership of the EU. For example the amount of Foreign Direct Investment (FDI) from the EU to the UK is also extremely considerable. The EU is not only a major source of inward FDI it is also a major recipient of UK investment. In 2014, EU countries accounted for just under half the stock of FDI in the UK (£496 billion out of a total of £1,034 billion, 48%). This compares with 24% from the US and 28% from other countries. In terms of UK investment abroad, the EU accounted for 40% of the total UK FDI stock in 2014. Between 2004 and 2013 the EU has provided 48% of UK FDI.

The prospect of leaving the EU is speculated to have a significantly negative effect on one particular sector of the economy, financial services. In 2013 financial services exports to the EU totalled £19.4 billion and imports £3.3 billion. There are no tariffs on financial services; however, there are what are known as ‘passporting rights’, which allow UK-based institutions to function in other EU member states without having to have a branch there. Equally, non UK institutions can access the EU market by locating in the UK alone. There is serious concern that these passporting rights would be lost if

the UK were to leave the EU. By the end of 2013 there were 255 foreign banks operating in the UK, many of these may find other places to work from under these circumstances.

Those who have been making impartial economic commentary about the referendum have noticed that there has been a significant decline in business confidence as a result of the uncertainty surrounding the vote. This in turn has a negative effect on business investment and hiring decisions. Although the uncertainty in the lead up to the vote has been about the fact that people do not know what side will win, it is generally accepted that there is greater uncertainty attached to leaving as it is an unknown what sort of agreements could be made going forward; this is predicted to not only have a negative effect on business but also on the value of the pound. In part the conclusion that there would be more uncertainty after a Brexit is based on the fact that numerous commentators have predicted that no alternative scenario to membership would be as financially benefiting to the UK as continued membership.

The IMF in its report on the subject even the potential of a vote Leave means that economic activity has fallen to the lowest level in three years. They predict that a Brexit would create uncertainty about the UK’s economic relations with the EU and the rest of the world. The IMF does not believe that a new deal with the EU would necessarily be easy for the UK to negotiate, and neither would the agreements with over 60 non-EU countries that are currently covered by EU-level agreements. These issues could remain unresolved for years, meaning that the uncertainty continues and in the meantime the UK economy suffers. Besides the instability the IMF also predicts that if the UK were to leave the Union then it would suffer income losses, as trade would most likely become more expensive.

The OECD has also in its report on the matter pointed out the issues surrounding uncertainty. They believe in the short term this will result in the UK seeing its GDP fall, as trade barriers increase and labour mobility decreases. They estimate that by 2020 GDP would be 3% smaller (equivalent to £2,200 per household) than it would otherwise have been; by 2030 they believe that this figure will have risen to 5% (equivalent to £3,200 per household).

The Treasury itself has also categorically stated that none of the alternatives to continued membership would support trade or provide influence on the world stage to the same level as continued membership. They have gone as far as to say that “families would be substantially worse off if Britain leaves the EUâ€.

You may also access this article through our web-site http://www.lokvani.com/